The Tax Law Research Group will work to develop and strengthen an objective research community in Tax Law that operates independently without siding with neither the state nor the taxpayers, with the ultimate aim of academically elevating the field of tax law research and to deepen the understanding of fundamental tax law principles. The Tax Law Group is a forum for development of new research projects, ongoing tax law debate, as well as seminars and events on current tax law topics.

The Research Group is headed by Associate Professor Henrik Skar. The members of the Group research key areas of Tax Law and connected legal fields. The Group includes the external affiliated members associate professors Oddleif Torvik and Tormod Torvanger from The Norwegian School of Economics (NHH) and professor Peter Koerver Schmidt from Copenhagen Business School (CBS Law), Denmark.

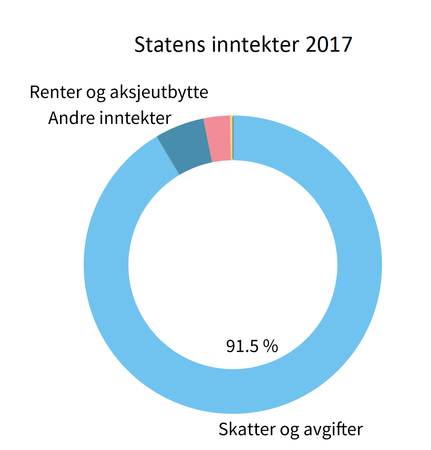

Tax law is an important legal field in modern society, seen from the perspectives of both the state and the taxpayers. The Norwegian State is entirely dependent on the payment of different taxes (incl. Employers and Employee Social Security Contributions) to finance its ongoing activities, including the comprehensive Norwegian Welfare System (in Norwegian: Folketrygden). For those liable to tax to Norway, be they businesses or individuals, the payment of taxes represents a significant burden.

The domestic Norwegian tax law system faces influence from international institutions, in particular the OECD. Increased globalisation and digitalisation of the economy will further strengthen this tendency. With its developed network of tax treaties and a strong tax administration that closely follows the international development, Norway has a sound point of departure for dealing with the fiscal challenges that loom.

There is a real need for objective tax law research to clarify the interpretation of current law. Such research will inform the users of the law – primarily the state and the taxpayers - and contribute to making the tax law predictable and practicable for them. The courts, that must settle disputes between the mentioned two parties, will also benefit from such research. An additional task for the Tax Law Research Group is to assists the Norwegian Legislator in developing new tax regulations.